Your read progress

British Bank Awards 2017 - The Winners

4 minute read

Updated 17th September 2025 | Published 20th February 2017

Thousands of UK consumers have been voting for their favourite bank accounts, credit cards and more as part of the British Bank Awards 2017.

Now in its third year, the British Bank Awards aims to give consumers a voice - the winners are determined by customers votes, and to help millions of UK customers to find the very best financial services providers on the market.

first direct still dominates

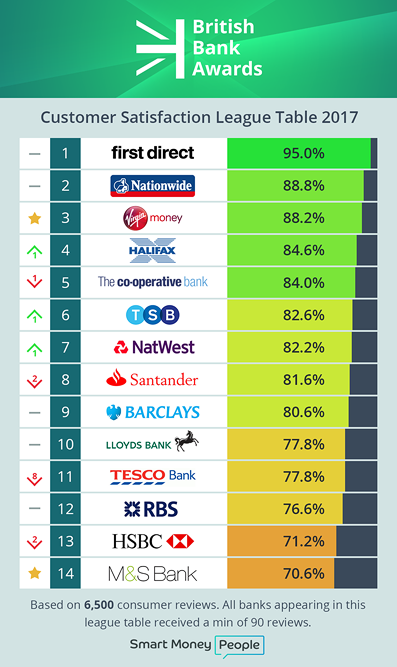

For an incredible third year in a row, Leeds-based first direct once again dominates the awards, winning 5 in total including Best British Bank with a customer satisfaction rating of 95%. As well as being named “Best Current Account Provider” for their popular 1st Account, they also take home three of our top-level awards: “Best Customer Service”, “Best Value for Money”, and “Most Recommended Bank”.

Joe Gordon, Head of first direct, said: “At the heart of first direct is the belief that people matter more, so to be voted Best British Bank for the third year running means a lot to us. We know if we’re to help customers live their lives the way they want to live them, we need to keep on developing and evolving. We need to provide amazing digital services and value for money products, but also have real people on hand 24/7 to help customers with the more complex life choices around money.”

Nationwide remain first direct’s strongest competitor, holding the runner-up spot in our customer satisfaction league table for a second year. Other multiple winners were Virgin Money and Zopa, both scooping two British Bank Awards each.

Virgin Money win “Best Newcomer”, making an impressive new entry to our banking league table in second position. They also won the coveted “Best Credit Card Provider”, won last year by Barclaycard. Bill Percy, Customer Experience Director at Virgin Money, said: "Delivering great service for our customers is at the heart of Virgin Money’s approach to banking, and we’re delighted to receive this recognition for the strides we are making, particularly as it’s voted for by customers themselves."

Popular peer-to-peer lending company Zopa also scored highly, taking home “Best Personal Loan Provider” as well as “Best Alternative Finance Provider”. Zopa CEO Jaidev Janardana said, "We’re proud to be voted ’Best Personal Loan Provider’ for the first time by the British Bank Awards. Over 245,000 customers have already chosen our low rate, flexible loans, and as we grow we will continue to offer UK consumers simple and fair financial products. This award is a testament to our customer-centric approach to building products and the better value we provide consumers.”

Further down the table, HSBC (who also operate first direct), and its joint venture with M&S, M&S Bank, take the bottom two spots of our league table. Also moving down the customer satisfaction league table are Santander, who (in)famously cut the interest rate on their popular 123 Current Account for a second time just a few weeks ago, and Tesco Bank, who performed well in the 2016 awards but drop eight places this year.

The full list of British Bank Awards 2017 winners:

Best British Bank: first direct

Innovation of the Year: Bud

Most Recommended Bank: first direct

Best Customer Service: first direct

Best Value for Money: first direct

Best Newcomer: Virgin Money

Best Current Account Provider: first direct

Best Business Banking Provider: Barclays

Best Mortgage Provider: Nationwide

Best Credit Card Provider: Virgin Money

Best Savings Provider: Vernon Building Society

Best Personal Loan Provider: Zopa

Best Alternative Finance Provider: Zopa

Best Banking App: NatWest

Best Personal Finance App: Money Dashboard

Overall customer satisfaction levels decrease

Overall, customer satisfaction across banking has dropped from 82% to 80%, in a sign that more competition and a greater focus on innovation haven’t yet translated into happier customers.

But digital offerings prove key

As part of the voting process, some 84% of customers told us that they now prefer banking online or via a mobile app, but poor functionality proves to be a significant source of frustration, with M&S Bank customer Mark Folwell asking: “has no-one told them we are in the 21st century?”. NatWest won “Best Banking App” - a new category for the 2017 awards reflecting that fact that consumers are increasingly turning to mobile to manage their banking.

Other causes of frustration include high overdraft charges, and the feeling that banks aren’t willing to help when times are tough. HSBC customer Kate Jones, said: “when you ask for help after a difficult few months you get a knock back, even after being a customer for over 20 years.”

So what’s ahead for the British Bank Awards 2018? Customers have been telling us that challenger banks aren’t always all they’re cracked-up to be, and seeing M&S Bank enter our league table in last place is a sign that more competition doesn’t always equal better customer outcomes. That said, we’re looking forward to seeing what the year ahead brings, when a rush of new banks like Atom Bank, Starling Bank and CivilisedBank start to really compete for our attention.”

So will a raft of new challenger banks sweep up our awards next year? Or will first direct make it four years in a row as the nation’s favourite? Sign up to Smart Money People to receive our updates, or leave a review today and continue to help others find the best financial services.

Smart Money People is the UK’s leading review and insight hub. Find out more about us by clicking here.

Written by Smart Money People Team

As Featured By

Join our mission

We use the power of consumer reviews to help increase trust and transparency in financial services and to deliver industry leading insight and events.

Write a reviewExplore our other topics

Guides: Smart money guides

Guides: Smart money tips

Guides: Business guides

Blogs: Money choices