Your read progress

Mettle: how it can change the business banking game

3 minute read

Updated 17th September 2025 | Published 16th November 2018

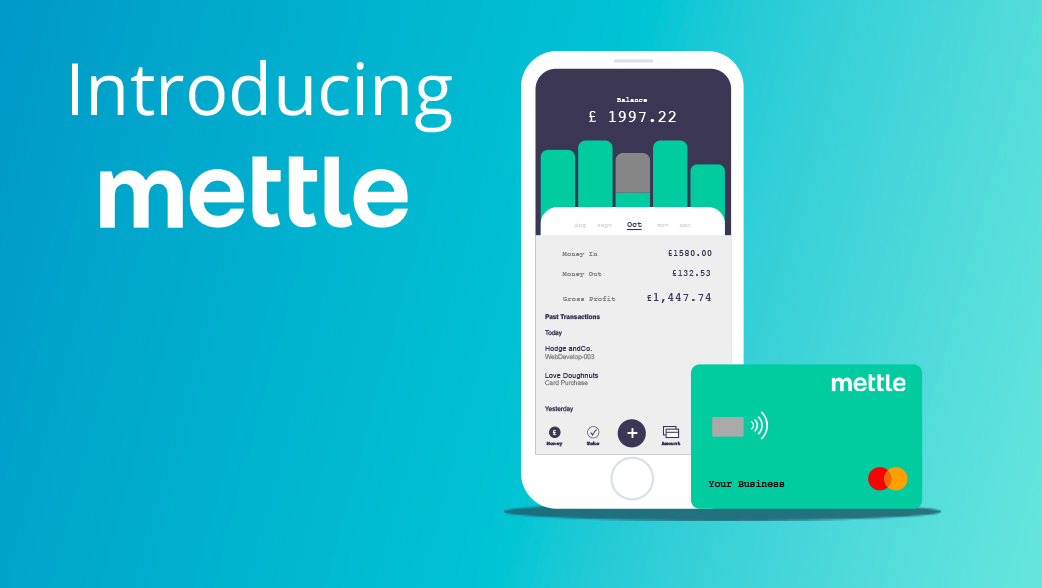

Meet Mettle, a new challenger brand wholly-owned by Royal Bank of Scotland (RBS).

Mettle isn’t just another new bank with an app-based current account, as was initially rumoured (think Monzo and Starling Bank). Or providing more competitive mortgage and savings rates (think Paragon Bank and Atom Bank).

Instead, Mettle, which is now in beta, will be a digital bank for businesses. And this makes it noteworthy. By targeting a thus-far under-served audience – small and medium businesses (SMEs) – Mettle could emerge as an important player in the business banking landscape.

The state of business banking in the UK

It’s staggering that the UK’s top 4 banks still account for well over 80% of all business banking accounts, and many business banking customers are all too aware of frustrating service levels and charges for things most consumers take for granted.

It can take anywhere from a few days to months to open a business account. Unlike personal current accounts, which have long been considered ‘free’ by consumers, most business accounts have hefty fees and charges at every turn, ranging from monthly account charges to charges for depositing cheques and withdrawing cash.

This is why Mettle and its competitors make sense. It’s no secret that consumers are adopting an increasingly digital-first attitude to banking, and this need is largely being met. It’s about time the same was done for businesses.

How Mettle could change things

Mettle emphasises speed and digital experience.

It promises that customers will be able to open a business current account within minutes. The app also offers invoicing and cash flow forecasting features.

There’s a clear influence from the challenger banks in this respect, whose apps are also designed to be fully-functioning financial assistants rather than just current accounts. Even the branding has similarities, from the lowercase lettering to the Monzo-esque, brightly-coloured debit card.

Mettle will face stiff competition from the likes of Starling Bank and Coconut, whose business banking offerings, although highly regarded, are far from perfect.

Starling’s business account is known for its speed and spending insights but has been criticised for a lack of communication between them and their business customers.

Coconut, which is designed specifically for freelancers and the self-employed, aims to fully automate accounting and tax returns alongside its current account offering. But the fees charged on the account might be off-putting for many smaller business owners.

What’s next for Mettle and business banking

Mettle’s launch is a sign that business banking is starting to heat up. More new banks will join Mettle, Metro Bank, Starling Bank and Coconut soon. Of these, CivilisedBank is the most notable, with relationship managers at the heart of its proposition.

It remains to be seen how heavily RBS will invest in Mettle, but we know it’s an important space for the brand. Last year, RBS launched the rather vague-sounding Esme Loans, which provides unsecured business loans to UK SMEs, much in the same way as firms like iwoca.

Time will tell if Mettle is really about to capture the hearts, minds and bank accounts of UK businesses, but what’s certainly true is that business banking does need a dose of healthy competition.

Written by Smart Money People Team

As Featured By

Join our mission

We use the power of consumer reviews to help increase trust and transparency in financial services and to deliver industry leading insight and events.

Write a reviewExplore our other topics

News: Awards

News: Industry news

News: Smart Money People news

Guides: Smart money guides

Guides: Smart money tips

Guides: Business guides

Blogs: Money choices