Your read progress

Mortgage Lender Benchmark H2 2022: The Results

4 minute read

Updated 15th September 2025 | Published 7th December 2022

Today we have released our latest Mortgage Lender Benchmark, which covers mortgage broker opinions on UK mortgage lenders for the second half of 2022.

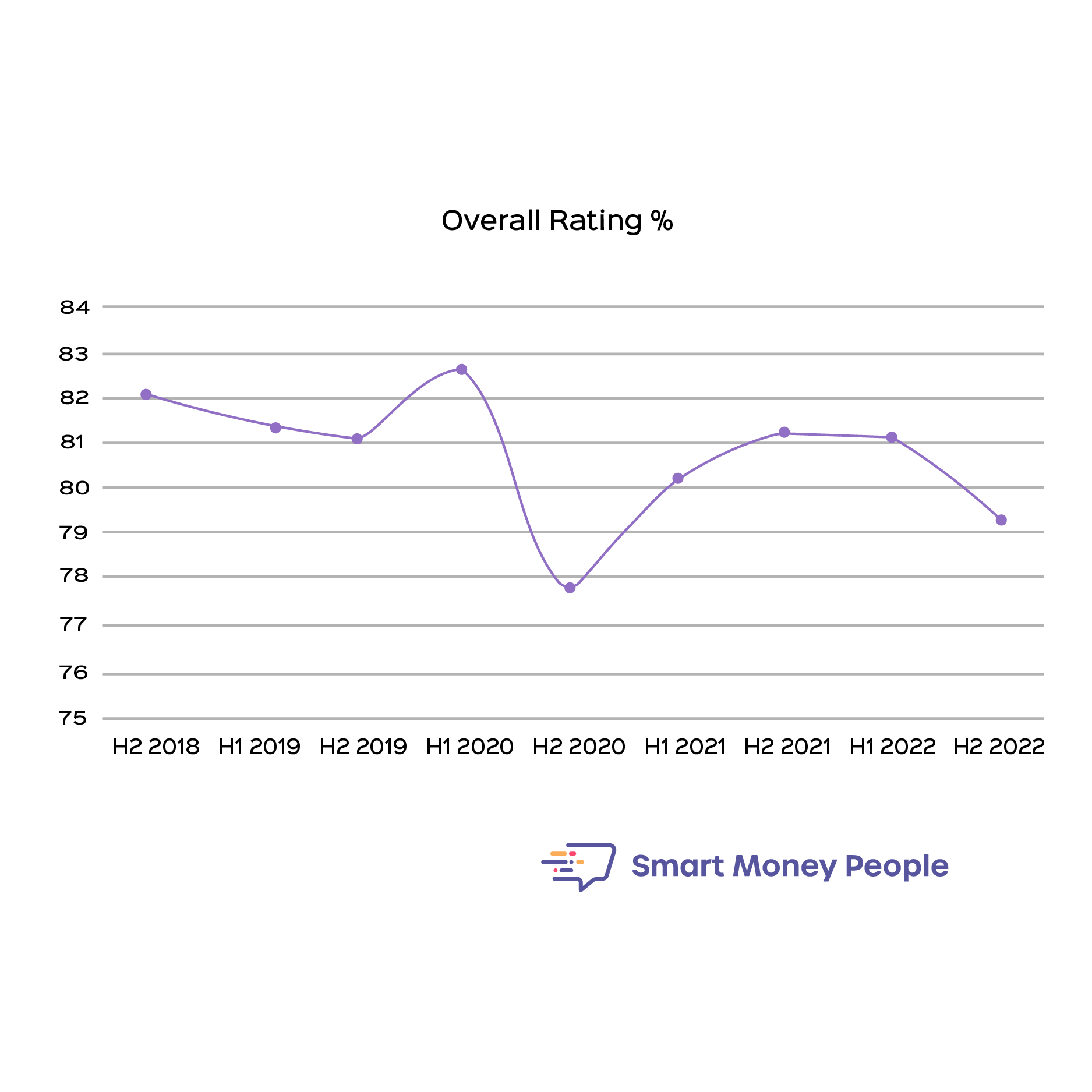

Our latest results has found that broker satisfaction with UK mortgage lenders has fallen to the lowest level recorded outside of the pandemic, as the market reacts to the cost of living crisis and turbulent economic climate of the second half of the year.

The results form part of our twice-yearly Mortgage Lender Benchmark which dissects the state of the mortgage industry according to the views of brokers. The latest edition comprises feedback from over 750 mortgage brokers on 114 mortgage lenders.

Key findings from our Mortgage Lender Benchmark H2 2022

- Overall broker satisfaction with lenders has fallen, down 1.9% to 79.3%, falling below 80% for the first time since H2 2020 (77.8%)

- Net Promoter Score (NPS) is down 5.8 points on H1 2022 at +21.1. Scores ranged from -54.5 to +59.3 for the lenders in the report

- Building societies are the top-rated sector for broker satisfaction for a ninth time

- Specialist lenders have broken their streak of improvement, with overall satisfaction down by 5.5% compared to H1 2022

- Broker ratings for lifetime lenders have seen the smallest change with overall satisfaction down by 1.1%, and have improved their rating for speed by 2.4%

- Broker satisfaction with relationship managers decreased by 1.1% and now stands at 77.8%

- Brokers are struggling to keep up to date with rapidly changing criteria and rates, with 43% relying on emails to keep updated with changes

Top broker rated lenders for H2 2022:

- Top bank: Halifax

- Top building society: The West Brom

- Top buy to let lender: Foundation Home Loans

- Top specialist lender: Foundation Home Loans

- Top lifetime lender: Canada Life

Commenting on the findings, Jacqueline Dewey, CEO of Smart Money People said:

The results we’ve published today shows a sharp drop off in brokers’ opinion following three editions of growth as UK lenders struggle to cope with the impact of the interest rate rises and turbulence caused by the ‘mini-budget’. Our analysis shows that broker satisfaction with mortgage lenders is now nearing the lowest recorded levels seen during the height of the pandemic.

“Brokers are frustrated by the situation they find themselves and their clients in, with constant changes and products being withdrawn after applications have been submitted. Our analysis has found brokers are craving some stability within the market, and that brokers need support from lenders – they need to be able to rely on and have confidence in lenders, and whilst processes adapt, communication remains key.”

Overall ratings for mortgage lenders

We asked brokers to give a score for satisfaction on a scale of one to five, for each of the last five mortgage lenders they’ve attempted to place a case with. This gave us an overall picture of broker satisfaction in the market, and for the individual lenders.

After satisfaction remaining level from H2 2021 to H1 2022, 2022, overall broker satisfaction for H2 2022 is down 1.9% to 79.3%, the lowest level recorded outside of the pandemic in H2 2020 (77.8%).

The highest lender in our report had an overall rating of 90.0%, and the lowest was 53.6%.

Net Promoter Score

We capture the Net Promoter Score (NPS) for each lender, which is a measure of how likely brokers are to recommend a lender. It is essentially a measure of loyalty. The average score for all lenders within the benchmark decreased by 5.8 to +21.1. The peak Net Promoter Score for all lenders was recorded at the start of 2020 at 30.8.

How the different mortgage sectors compare

When we analyse broker feedback, we split the UK mortgage lenders into four sectors – banks, building societies, specialist lenders and lifetime lenders.

Building societies have the highest levels of broker satisfaction of any sector, which we’ve seen across the last nine editions of our Benchmark.

Specialist lenders have seen a considerable fall in their metrics following previously recorded improvements. Overall satisfaction has fallen by 5.5% to 75.0%, and their Net Promoter Score is down 24.6 points, to just +1.2.

Lifetime lenders, however, see the smallest change in overall satisfaction, down 1.1%, and their rating for speed has increased 2.4% to 73.8%, as they overtake the banks.

Download a summary of the report now

To download a summary copy of the report or to purchase your full copy, head to our dedicated Mortgage Lender Benchmark H2 2022 page.

About the Mortgage Lender Benchmark

- The Mortgage Lender Benchmark is a bi-annual report released by Smart Money People in June and December each year.

- The H2 2022 report is the ninth edition of the report, which started in H2 2018.

- The report captured feedback from 751 brokers.

- Mortgage brokers were asked to leave feedback on the last five lenders they’ve attempted to place a case with recently, as well as other providers they use within their mortgage business, and their comments on the mortgage market in general.

- The data capture period was October 2022.

- Data on 114 lenders was captured as part of the study and 51 lenders feature in the in-depth analysis

- Smart Money People analyses the comments that brokers provide when asked what they like or what could be improved for each lender. These are mapped across 20 themes to give a rich insight into how each lender is performing.

Written by Emma

Head of Marketing

Emma joined us in 2021. She is passionate about ensuring others make good choices with their money using all the information and data available.

As Featured By

Join our mission

We use the power of consumer reviews to help increase trust and transparency in financial services and to deliver industry leading insight and events.

Write a reviewExplore our other topics

Guides: Smart money guides

Guides: Smart money tips

Guides: Business guides

Blogs: Money choices